If you've been feeling a mix of curiosity, confusion, and confidence when it comes to the commercial construction market we find ourselves in, you're not alone. Facing a need to expand operations? Craving some insights? To help us all navigate this turbulent marketplace, we’ve consulted our own experience, plus a list of insightful US and Michigan data sources. We hope the hindsight that follows gives you useful context for future decision-making.

Industrial Construction Boom

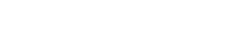

Few predicted the huge expansion of US industrial property that has taken place since 2019. Commercial real estate firm Cushman and Wakefield summarized the shocking current reality in this quote from a 2023 report. “Since 2020, 1.8 billion square feet of industrial product has been delivered across the U.S. – surpassing the total construction output of the entire previous decade.”

This growth is the result of three consecutive record-breaking years of non-residential new building construction. In 2023 alone, more than 610 million square feet of industrial space was delivered. This amounts to 3.7% of total US industrial inventory being constructed in just the past year. Greater Grand Rapids saw a similar trend with steady growth since 2019, culminating with 1.9 million square feet of new industrial space delivered from Q3 2022 to Q3 2023. (Source: The Right Place)

Few predicted the huge expansion of US industrial property that has taken place since 2019. Commercial real estate firm Cushman and Wakefield summarized the shocking current reality in this quote from a 2023 report. “Since 2020, 1.8 billion square feet of industrial product has been delivered across the U.S. – surpassing the total construction output of the entire previous decade.”

This growth is the result of three consecutive record-breaking years of non-residential new building construction. In 2023 alone, more than 610 million square feet of industrial space was delivered. This amounts to 3.7% of total US industrial inventory being constructed in just the past year. Greater Grand Rapids saw a similar trend with steady growth since 2019, culminating with 1.9 million square feet of new industrial space delivered from Q3 2022 to Q3 2023. (Source: The Right Place)

Experts agree that this unprecedented pace of construction is not likely to continue. The American Institute of Architects predicts non-residential construction growth of just 4% in 2024 and 1% in 2025, with the manufacturing sector remaining strong at 10% growth in 2024.

The Mega-Project Factor

Industrial projects valued at more than $1 billion are somewhat to blame for the stark upward trend. In the US there were 31 so-called “mega projects” in 2022 and 41 in 2023. According to constructionconnect.com, mega projects contributed over $100 billion to annual total new construction spend for the past 2 years. Some of these projects benefitted from funding provided by the US Inflation Reduction and CHIPS Acts. Shifts in consumer patterns and sustainability initiatives are driving the need for huge new mega facilities:

- Logistics centers and warehouses needed to support pandemic fueled e-commerce growth.

- Veneklasen Construction has been an active partner in logistics expansion having built or expanded 14 facilities across the US in recent years.

- Power and green energy infrastructure are a national priority.

- Newer and bigger data centers required to power artificial intelligence expansion.

- Electric vehicle battery plants needed to meet growing EV demand. Two EV battery plants are planned in West Michigan – in Mecosta and Ottawa Counties.

Winners and Losers in Commercial Real Estate

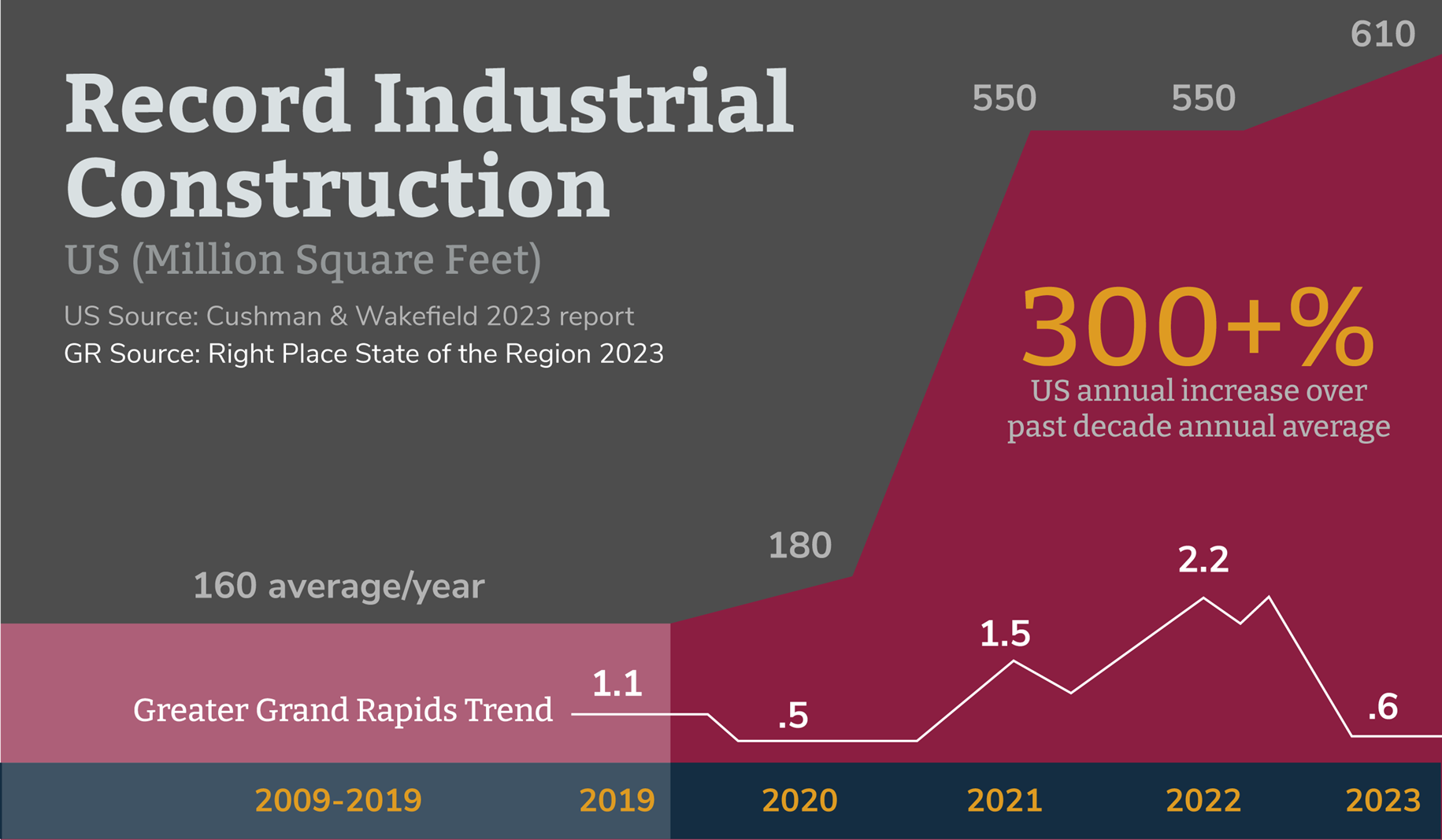

Construction spending to support manufacturing operations increased by 59% in 2023 and is expected to be a large share of the commercial construction spending pie in 2024. Construction of religious, education, and healthcare buildings also saw double-digit growth in 2023. Declines in construction of retail and office space is a national trend. Consumer and worker behaviors that started during the pandemic have become the new normal.- Remote work trend: Today’s 30% rate of paid remote workdays is expected to be the long-term norm. This represents six times the prevalence of remote work compared to 2018. The value of US office space is down 15% this year (Source: MSCI Commercial Property Index). The Greater Grand Rapids market is relatively stable with a 14% office vacancy rate, however development of new office space has stalled since 2022. (Source: The Right Place)

- Shift to e-commerce: The pandemic made e-commerce a necessity. Consumer choice has since made it preferred over some traditional brick and mortar experiences. US e-commerce sales have been increasing at a 15% annual pace and are projected to exceed $1 trillion this year. The value of US retail space is down 7% this past year. (Source: MSCI Commercial Property Index)

Economic Factors Make It a Volatile Playing Field

Input Costs: While the supply chain issues of 2021 that saw lumber and other commodity prices skyrocket have stabilized, prices remain high. According to an AIA report, building materials in the US have settled in at 35%-40% above pre-pandemic levels. Construction labor costs are also on the rise, outpacing overall wage growth.

Input Costs: While the supply chain issues of 2021 that saw lumber and other commodity prices skyrocket have stabilized, prices remain high. According to an AIA report, building materials in the US have settled in at 35%-40% above pre-pandemic levels. Construction labor costs are also on the rise, outpacing overall wage growth.

Veneklasen Construction has seen these same trends play out in Michigan. “Trade partners must pass on higher wage rates, and we’re getting used to lumber and steel prices being 30% higher than pre-pandemic levels.” Says Rob Miller, Sr. Estimator “One bright spot is improving lead times. At its worst, supply chain issues caused lead times of up to 12 months for steel building materials. Now we’re looking at 10-12 weeks or better.”

US government investment: Incentives from Inflation Adjustment Act legislation of 2022 have flooded the market. Energy focused projects dominate both public and private sector projects. Analysts at major investment banks estimate the total amount of clean energy spending by the end of the decade could be between $1 and $3 trillion. This massive influx of financing is further impacting materials price inflation, construction labor shortages, as well as the increasing cost of labor.

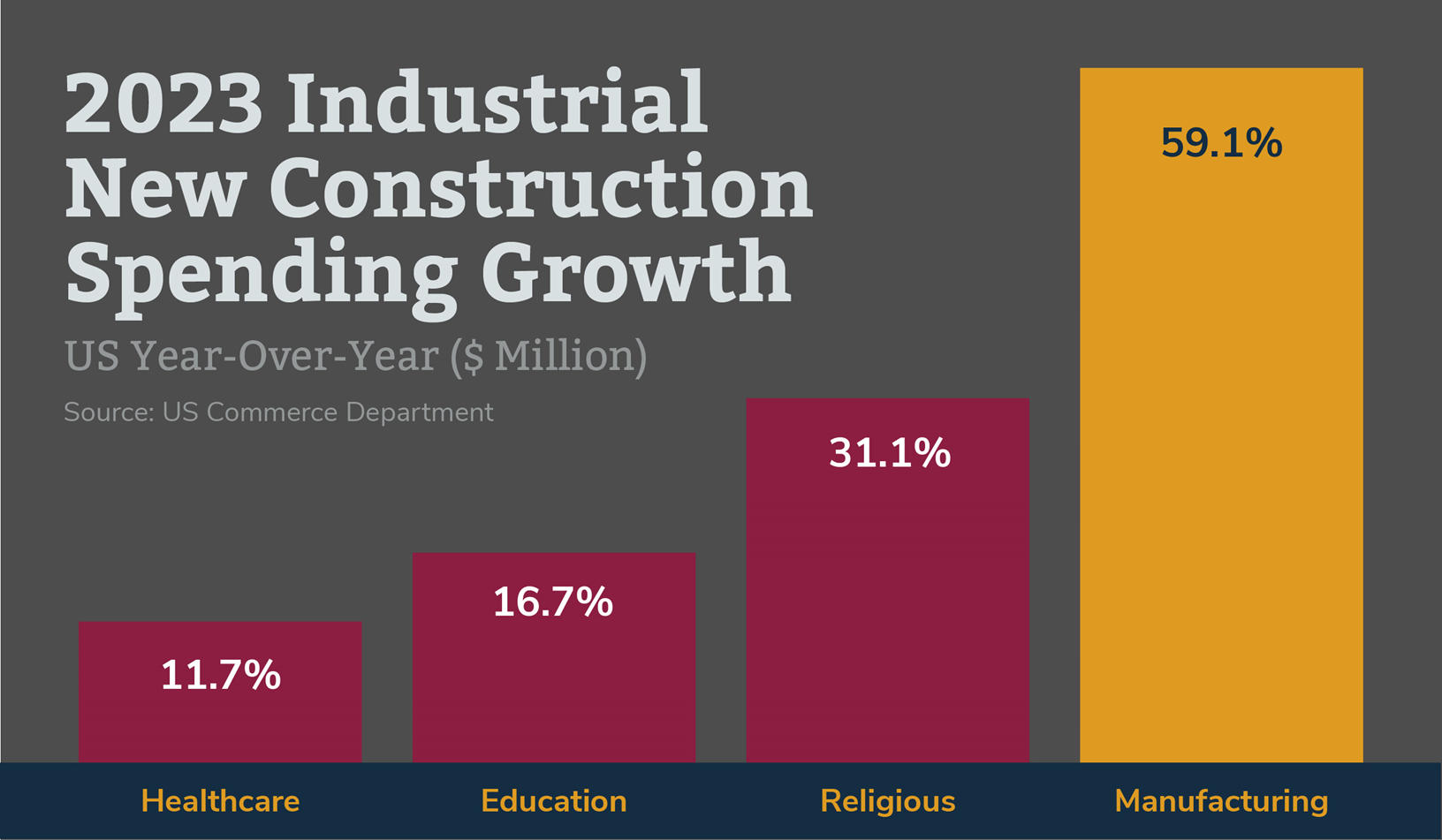

Tight credit market: High interest rates continue to impact residential and non-residential construction starts. While projects that benefit from government incentives are moving full speed ahead, new commercial construction and expansion projects can be at risk due to financing challenges.

Tight credit market: High interest rates continue to impact residential and non-residential construction starts. While projects that benefit from government incentives are moving full speed ahead, new commercial construction and expansion projects can be at risk due to financing challenges.

Veneklasen Construction has advised many clients regarding financing strategies in this tight credit market. “Engaging our team and partners during the pre-construction phase of a project has become vital” says Bill Lee, Veneklasen Construction VP, Business Development. “This is where we use our VENEBUILT process to get creative and strategic. When we can match clients to the right local and regional financial incentives, we help to make their project possible.”

Vacancies and land scarcity: Commercial space in the office sector is plentiful and property values are declining, while low vacancies in the industrial and manufacturing sector are fueling higher property values and demand for new construction. In West Michigan and other Midwest markets, the scarcity of land for commercial construction is one more issue facing commercial development. Veneklasen Construction leverages our knowledge of the commercial real estate market and deep experience working with local municipalities to help customers overcome the land scarcity challenge.

Tips For Building Industrial Spaces in Michigan

Industrial construction in Michigan, like the rest of the Midwest region, is strong. Driven by record low industrial property vacancies in Grand Rapids of 2.1% in early 2023, development is expected to continue. Big investments in logistics and warehouse space and EV battery and parts plants are underway, while there is evidence of a tapering of new construction starts in other industrial sectors across the state. If you will be breaking ground on a new project this year, we advise early conversations with the Veneklasen team to develop strategies to combat the land scarcity, financing, and material cost inflation situations you may face. Over the past 3 years, we’ve encountered these challenges and more. The result is a smarter Veneklasen team and new solutions that keep projects on track and within budget despite some pretty strong headwinds.We offer you these tips that will reduce uncertainty and allow you to move your project ahead confidently: |